Page 134 - CCRT-Annual-Report-2016-17-flip

P. 134

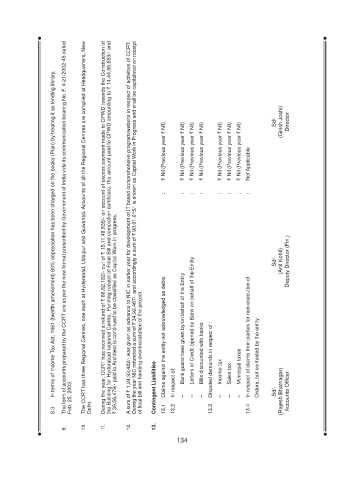

During the year, CCRT has received a refund of ` 66,82,182/- out of ` 15,11,48,835/- on account of excess payment made to CPWD towards the Construction of

the Building for Hyderabad regional Centre, Pending receipt of Final Bill and completion certificate, the amount paid to CPWD amounting to ` 14,44,66,653/- and

During the year NIC refunded a sum of ` 34,92,467/- and accordingly a sum of ` 90,01,015/- is shown as Capital Work in Progress and shall be capitalized on receipt

A sum of ` 1,24,93,482/- was given as advance to NIC in earlier year for development of IT based comprehensive program/website in respect of activities of CCRT.

The CCRT has three Regional Centres, one each at Hyderabad, Udaipur and Guwahati. Accounts of all the Regional Centres are compiled at Headquarters, New

The form of accounts prepared by the CCRT are as per the new format prescribed by Government of India vide its communication bearing No. F. 4-21/2002-45 dated

In terms of Income Tax Act, 1961 (twelfth amendment) 60% depreciation has been charged on the books (Plan) by treating it as lending library.

` Nil (Previous year ` Nil) ` Nil (Previous year ` Nil) ` Nil (Previous year ` Nil) ` Nil (Previous year ` Nil) ` Nil (Previous year ` Nil) ` Nil (Previous year ` Nil) ` Nil (Previous year ` Nil) Not Applicable Sd/- (Girish Joshi) Director

: : : : : : : :

` 39,56,479/- paid to Architect is continued to be classified as Capital Work in progress.

(Anil Kohli) Deputy Director (Fin.)

Letters of Credit opened by Bank on behalf of the Entity

Sd/-

Bank guarantees given by/on behalf of the Entity

Claims against the entity not acknowledged as debts

of final bill and handing over/installation of the project.

Bills discounted with banks Disputed demands in respect of : tax tax taxes Municipal In respect of claims from parties for non-execution of Orders, but contested by the entity

Feb. 25, 2003. Contingent Liabilities In respect of: – – – Income – Sales – – Sd/- (Rajesh Bhatnagar) Accounts Officer

8.3 Delhi. 13.1 13.2 13.3 13.4

9. 10. 11. 12. 13.

134