Page 134 - CCRT-Annual-Report-2013-14

P. 134

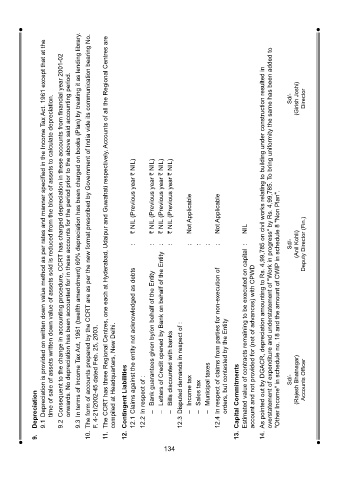

9.3 In terms of Income Tax Act, 1961 (twelfth amendment) 60% depreciation has been charged on books (Plan) by treating it as lending library.

10. The form of accounts prepared by the CCRT are as per the new format prescribed by Government of India vide its communication bearing No.

The CCRT has three Regional Centres, one each at Hyderabad, Udaipur and Guwahati respectively. Accounts of all the Regional Centres are

9.1 Depreciation is provided on written down value method as per rates and manner specified in the Income Tax Act. 1961 except that at the

9.2 Consequent to the change in accounting procedure, CCRT has charged depreciation in these accounts from financial year 2001-02

14. As pointed out by DGACR, depreciation amounting to Rs. 4,99,785 on civil works relating to building under construction resulted in

onwards. No depreciation has been accounted for in these accounts for the period prior to the above said accounting period.

(Girish Joshi) Director

Sd/-

time of sale of assets written down value of assets sold is reduced from the block of assets to calculate depreciation.

R NIL (Previous year R NIL) R NIL (Previous year R NIL) R NIL (Previous year R NIL) R NIL (Previous year R NIL) Not Applicable Not Applicable

"Other Income" in schedule no. 18 and the amount of CWIP in schedule 8 "Non Plan".

Sd/-

: : : : : : : : NIL : overstatement of expenditure and understatement of "Work in progress" by Rs. 4,99,785. To bring uniformity the same has been added to (Anil Kohli) Deputy Director (Fin.)

Depreciation F. 4-21/2002-45 dated Feb. 25, 2003. compiled at Headquarters, New Delhi. 12. Contingent Liabilities 12.1 Claims against the entity not acknowledged as debts 12.2 In respect of : Bank guarantees given by/on behalf of the Entity – Letters of Credit opened by Bank on behalf of the Entity – Bills discounted with banks – 12.3 Disputed demands in respect of : Income tax – Sales tax – Municipal taxes – 12.4 In respect

9. 11.

134